Your Guide to Building Financial Literacy

Why you need to grasp key terms

In today’s changing economic times, understanding financial concepts is crucial for making informed decisions about money. Whether you’re a seasoned investor or just a newbie, grasping key terms and concepts that experts throw around helps you confidently navigate the finance world. This blog is here to tell you all you need to know about fundamental concepts like liquidity, inflation, bull and bear markets, risk, and net worth, shedding light on how they impact our financial lives. Let’s start with liquidity all the way to all you need to know about your net worth.

Liquidity

Liquidity is the ease with which you can convert an asset (i.e. anything that’s useful or valuable) into cash without losing much value. Think of maybe wanting to sell your car, jewellery or even your house. Essentially, liquidity measures how fast you can access your money when needed. Cash is the most liquid asset because that’s what you use directly to buy stuff. On the other hand, assets like your house have lower liquidity because selling them either takes time or you might end up losing a lot of money in the process. Liquidity is crucial for managing emergency funds and ensures you have access to funds when unexpected expenses arise. Now that you know liquidity matters and it affects how fast you can get cash let’s look at how the value of your assets can be affected by inflation.

Inflation

Inflation is what’s going on right now; the general increase in prices of goods and services over time, results in a decrease in the buying power of your money. When inflation is high, the same amount of money can buy less stuff than before. Say you put $100 under your mattress every month, which gives you $12,000 after 10 years. Now, today you might be able to pay for 2 semesters of tuition fees for your child with that money; but in 10 years from now, tuition fees will increase because of inflation. You’ll still have $12k but you may only be able to pay for 1 semester with it. So you better invest wisely so your money grows with inflation! What this means is that you need to choose an investment that isn’t affected by inflation, and the value will increase over time. It doesn’t stop here because you also need to know how the markets change and the best time to plant your seed.

Bull and Bear Market

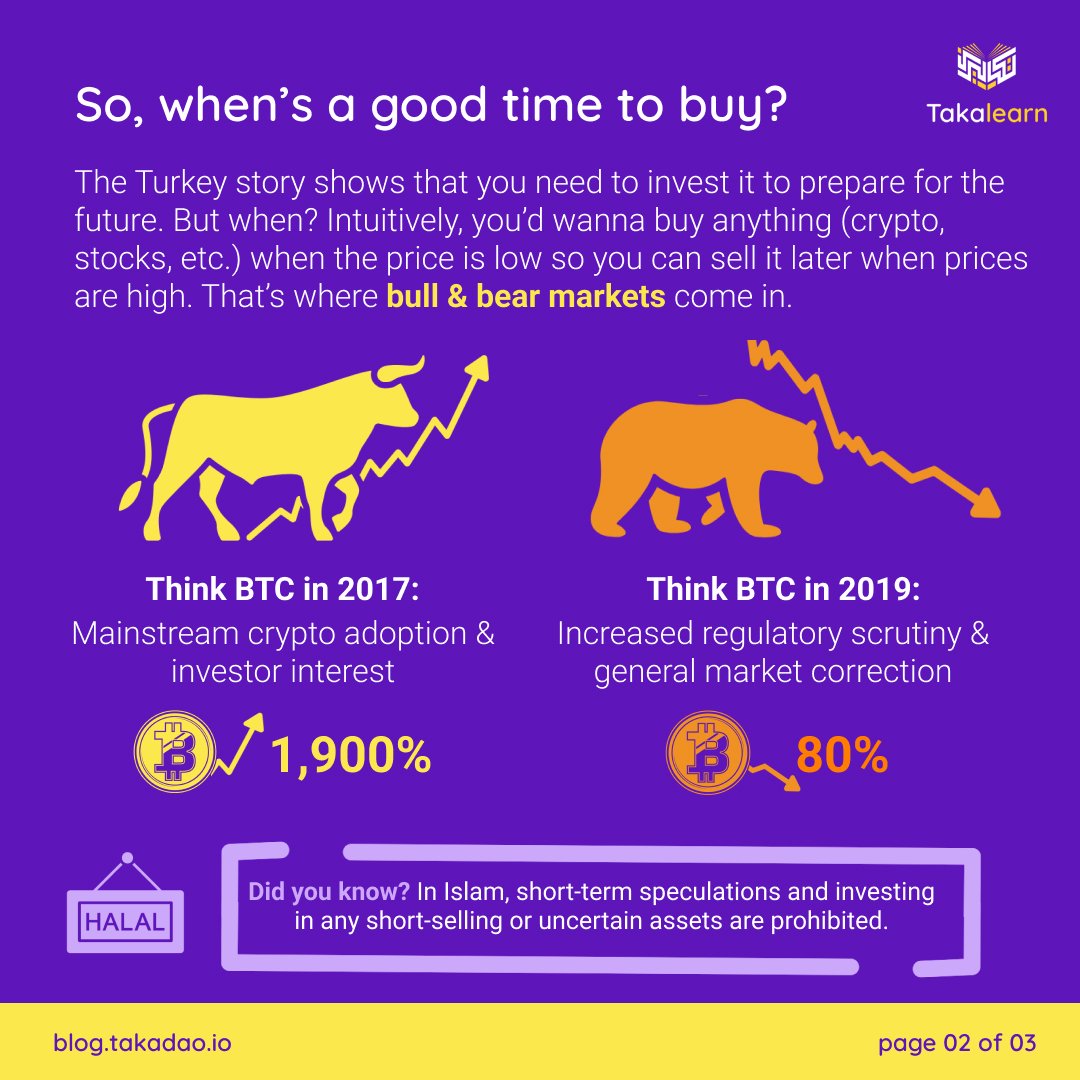

Great, now you want to invest in something that appreciates in value to outsmart inflation. But first, let’s look at the markets. Bull and bear markets are used to describe the overall direction of the stock market or a particular asset class. A bull market refers to a sustained period of rising prices, where investor optimism is high and there is a general expectation of further price increases. The increase in price is because of high demand and less supply of an asset (scarcity). The perfect example of a bull market happens during the Bitcoin halving where every four years, the reward for bitcoin miners is cut by half. Because of the reduced reward, there’s less incentive to mine, resulting in fewer miners. So, less Bitcoin is available but the demand is high. Think of it as having something that everyone wants to buy, and are willing to pay any price for it. A bull market shows a healthy economy and, most of the time, leads to increased investment activity. For you to always remember the bull market concept, think of the manner in which a bull attacks by thrusting its horns upwards.

On the other hand, a bear market is characterized by a prolonged price reduction, typically accompanied by investor pessimism and a lack of confidence in the market. The bear market concept is derived from the way in which a bear attacks by swiping downward with its paws. Think of the bear market as selling a car model that everyone wants. The price keeps going up because people are willing to pay more, but suddenly, people lose interest and start selling it instead of buying, and prices begin to reduce.

So, in real life, during the bear market, investors sell off their assets to avoid further losses or move into safer assets. Investors do this because they believe the prices will continue to fall, and as a result, this causes a further decline. Bear markets can be quite a challenge, and they can wipe out all your investment. Anyway, for some assets, it’s always good to buy when their prices are low and sell when their prices increase. That said, it’s always good to know the kind of investment you're getting into and the risks involved. Always invest what you can afford to lose, as we will see in the next part.

Risk

After all that we’ve touched on, you are now ready to put your money to work. Are you willing to take the risk? Risk is a natural part of any financial decision and refers to the uncertainty or possibility of loss. Like a game of soccer, there must be a winner and a loser even though both teams spend time practising and preparing for the game in every way. Investments have varying degrees of risk, and different assets have different levels of risk. Generally, the higher the risk, the greater the expected benefit. It is crucial to assess how much money you can risk losing and align your investments accordingly. Spreading investments across different asset classes (diversification) helps manage risk by reducing exposure to a single investment.

It’s also good to assess your overall financial health, like a kid’s academics in school. Check your grades, where you’re failing, where you are doing well and such. Read on to see how to calculate your net worth.

Net Worth

You have now chosen your investment plan and committed your money. It’s now time to know what you really have in terms of money or financial worth. Net worth is a measure of your financial health calculated by subtracting total liabilities from total assets. It represents the value of your financial holdings after accounting for obligations. Assets include cash, investments, real estate, and other valuables, while liabilities cover loans, mortgages, and credit card charges. Monitoring your net worth provides a snapshot of your financial progress over time and helps you track your financial goals. By calculating your net worth, you’ll know whether you're moving ahead, stagnant, or falling behind. If you’re not careful, you could be making two steps forward and one backwards. It may be a case of rocking chair investment where you are busy but not moving.

Conclusion

Building financial literacy is a journey that empowers you to make informed money decisions. With knowledge of liquidity, inflation, bull and bear markets, risk, and net worth, you can confidently navigate the complexities of the financial web. By continuously expanding your knowledge and seeking professional advice when necessary, you can develop a solid foundation for managing your personal finances and working towards your long-term financial goals. Don’t miss our next piece on managing your money and wealth.