Wealth Management

Your Guide to (Islamic) Money & Wealth Management

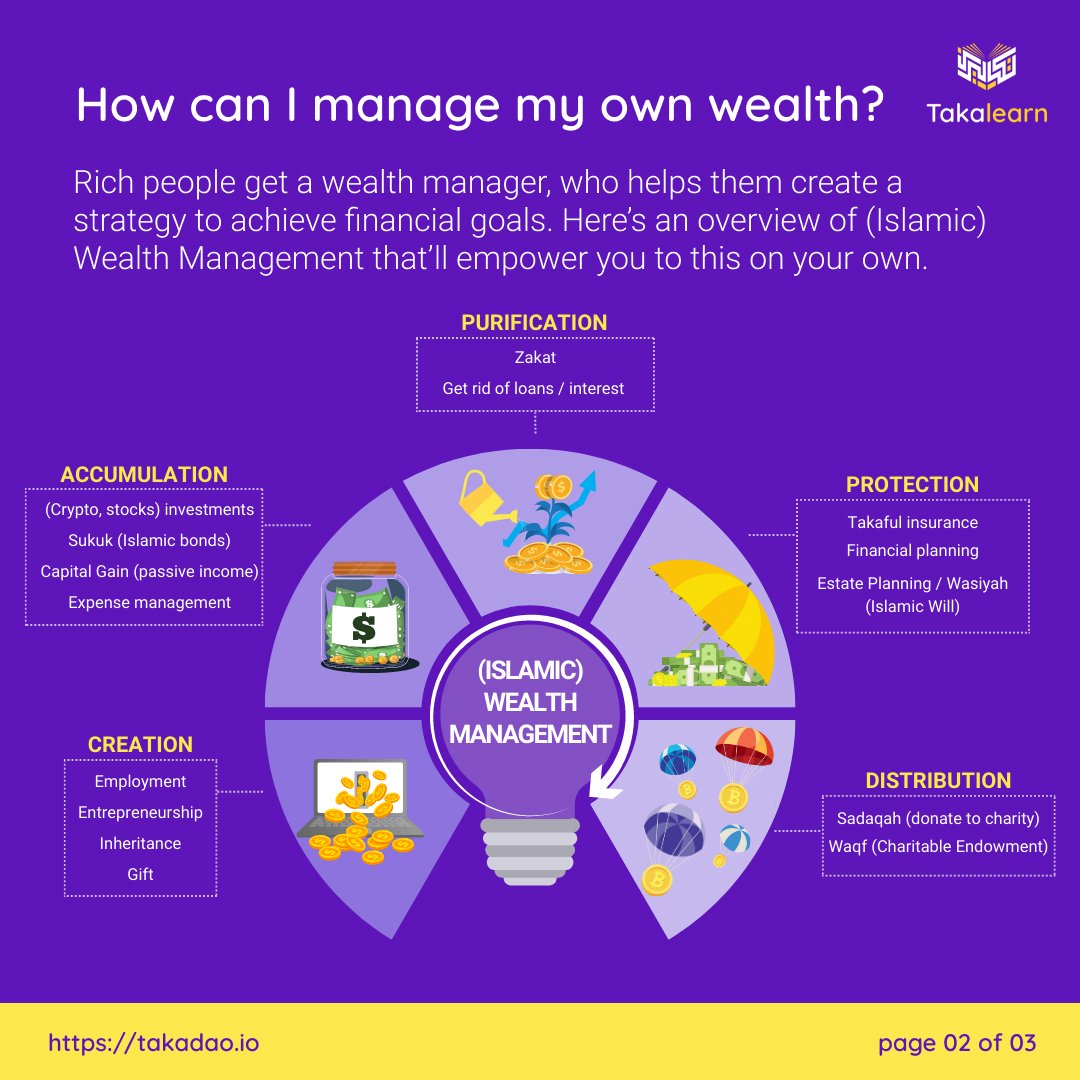

Your Relationship with Money

To build wealth, you need to have a healthy relationship with money. Do you ever feel like messing up with your money affects your emotions? Your guess is good as mine..the “Oops, I did it again” moment. Good money and wealth management are essential skills to offer you financial security and success. When you understand the basics of earning, saving, and consumption, you make the right decisions and create a solid foundation for a prosperous financial future. This blog post will discuss basic concepts like earning, Murabaha, Musharaka (Islamic financing principles), saving, and consumption. In the world of money and wealth management, we usually break it down into different segments based on certain concepts. However, we're taking a unique approach by looking at it through the lens of Islamic finance and dividing it into five categories. Here’s a good resource for more information:

https://argaamplus.s3.amazonaws.com/86f171a0-dcdc-4a26-b7f1-35345c16f250.pdf

Well, let’s jump right in and talk about the different ways of wealth creation.

Create your Wealth

Why do some people always talk about making money? Don’t be lied to. The only place that money is made is at the mint. For the rest of us, we must earn money as a reward for solving someone’s problem by offering a service or selling them an item. But, there are lucky ones who inherit or get money gifts. Earning generates income through various sources like employment and entrepreneurship. Earning is the foundation of financial stability and enables you to pay bills, save, and invest for the future. Having multiple sources of income, improving your professional skills, and looking for growth opportunities are key strategies for increasing earning potential.

So, first, let’s look at how you can earn and create wealth through employment. Employment is a stepping stone for creating wealth. Having a stable job can earn a regular income that forms the foundation for your financial growth. It is important to invest in your education, get valuable skills, and always seek opportunities for career advancement. Consistent efforts in these areas can lead to promotions, salary increases, and improved benefits, helping you accumulate wealth over time.

Second, entrepreneurship offers a great path for wealth creation by harnessing innovation, creativity, and business acumen. Entrepreneurship is a way of forging your own path. When you start your own business, you generate income independently while leveraging your unique skills and passion. Also, you can unlock significant wealth-building opportunities by identifying a market need and developing a viable business model.

It’s good to note that entrepreneurship needs careful planning, market research, and risk management. A solid business plan, effective marketing strategies, and financial discipline are important. Embrace the willingness to learn from failures and adapt to changing market conditions. To be a successful entrepreneur, you must invest considerable time and effort in building your ventures, but the potential rewards for financial gain and personal fulfilment can be substantial.

Third, you can also build generational wealth through inheritance. Inheriting wealth can be a significant catalyst for financial growth. However, it is important to know that inheritance alone does not guarantee wealth creation. You must manage inherited assets wisely, preserve wealth, and seek growth opportunities. Plus, depending on where you live, you’ll need to account for inheritance.

Lastly, being gifted can also be a way to create wealth, whether financial or non-financial. Gifts give you a head start or additional resources to fuel your financial journey. Monetary gifts can be used for investments, paying off debts, or funding entrepreneurial ventures, enabling you to expedite your wealth-building process.

Non-financial gifts, like mentorship, networking opportunities, or specialized knowledge, are equally valuable. They can open doors, offer guidance, and facilitate connections contributing to your personal and professional growth.

It helps you also balance what you earn and how to spend to ensure long-term financial well-being. After getting your reward, the next thing that follows should be saving and wealth accumulation, not consumption. Always try as much as possible to set some money aside for a rainy day before any spending.

Save and Accumulate your Wealth

You must set aside some of your income for future use or emergencies. Without savings, you’re like a soldier without armour. You can be hurt by any financial troubles that come your way. Ever heard of the Scout Motto? BE PREPARED! It is a basic aspect of financial planning and acts as a safety net during unexpected circumstances. Not only will saving give you financial security, but it will also allow you to pursue your long-term goals like homeownership, education, or retirement. Everything comes with practice. So, develop a habit of saving regularly, creating a budget, and prioritizing expenses. These are effective strategies for building a solid financial foundation. You will never have to beg from friends or relatives or be at the mercy of haram lenders.

After saving, how do you now accumulate your wealth? Let’s kick it off with investment. One of the most crucial aspects of wealth accumulation through investment is to start as early as possible. Time is a powerful investment ally, allowing you to leverage compounding returns over the long term. The earlier you start, the more time your investments have to grow and multiply.

Consistency is equally important. Regularly invest a portion of your income, regardless of market conditions. Implementing a disciplined investment approach, like setting up automatic contributions to retirement accounts or systematic investment plans, ensures a consistent and continuous commitment to building wealth.

The next step is to diversify. Diversification is a fundamental strategy to control risk and optimize your returns. By spreading your investments across different asset classes, sectors, and geographical regions, you reduce the potential impact of any single investment’s performance on your overall portfolio. Diversification also allows you to take advantage of varying market cycles and minimize the impact of volatility.

Considering a well-balanced portfolio that includes a mix of stocks, crypto, sukuk, Islamic funds, real estate, and other investment vehicles is important. So, explore investments with different risk profiles, from conservative to aggressive, depending on your financial goals and risk tolerance. Regularly review and rebalance your portfolio to align with your evolving objectives and market conditions.

Another point is to invest with a long-term goal in mind. Investing with a long-term perspective is a key principle to accumulating substantial wealth. While short-term market fluctuations can be unpredictable, the overall trajectory of well-managed investments tends to be upward over extended periods. Avoid succumbing to the temptation of trying to time the market or chasing quick gains, as such strategies often lead to suboptimal results. This is also an important principle from an Islamic perspective: short-term trading with the goal of chasing the market is prohibited because it is a form of gambling.

Instead, focus on quality investments with strong fundamentals and growth potential. Look for companies or assets with a track record of consistent performance and competitive advantages. Conduct thorough research, consult with financial advisors, and consider long-term trends and market forces that can drive sustained growth.

While investing, consider the capital gains. Capital gains are a significant driver of wealth accumulation through investments. Capital gains occur when the value of an investment appreciates over time, allowing you to sell it at a higher price than the purchase cost. By strategically selecting investments with the potential for capital appreciation, you can unlock substantial wealth over the long term.

To optimize capital gains, consider investing in growth-oriented assets, like stocks of companies with high growth prospects, emerging markets, or innovative industries. If you want to make halal investments, you’ll additionally have to screen potential investment opportunities on whether they are engaging in anything haram. In any case, be mindful of tax implications and explore tax-efficient investing strategies or defer capital gains through tax-advantaged accounts.

Let’s now look at the responsible way of spending what is left after saving and investing.

Consume and Purify Your Wealth.

Rule number one is to cut your coat according to your cloth. We live in an era where lavish lifestyles are the norm. Don’t succumb to peer pressure; try to please people with your lifestyle. Don’t fake it till you make it but make it so you don’t have to fake it. Spend on what you can afford and what your money allows without strain. Consumption is spending money on goods and services. Responsible consumption involves:

Making informed decisions about your purchases.

Clearly defining between needs and wants.

Aligning your spending with personal values and goals.

Practice mindful spending, avoid debt, and differentiate between short-term satisfaction. It is important to maintain a healthy balance between consumption and saving.

Zakat

Islamically, the concept of purifying wealth goes beyond accumulating riches; it emphasizes the ethical and responsible use of resources. For Muslims, making a lot of money is never the end goal. It is just a means to live in this world. That’s why one of the five pillars of Islam is Zakat, an obligatory 2.5% tax that Muslims annually give to community members in need in order to purify their wealth. The fact that this specific form of donation is one of the five things that every Muslim needs to do to call themselves a Muslim shows just how important the concept of purifying your wealth is in Islam.

Zakah serves as a means of wealth redistribution and social justice, addressing economic inequalities and alleviating poverty. It fosters empathy and compassion within society, encouraging individuals to fulfil their religious duty while contributing to the community’s well-being.

Outside of the obligatory Zakat, there are two principles that also embody the principle of purification and proper distribution of wealth: Takaful and Wassiyah. Let’s see how Takaful (Islamic insurance) and Wassiyah (Islamic will) play vital roles in ensuring wealth’s righteous and ethical management.

Takaful

Takaful is all about mutual protection and shared responsibility. Takaful is a system based on cooperation, mutual protection, and shared responsibility. It embodies the principles of solidarity and helping others in need while adhering to Islamic guidelines.

In Takaful, we pool our resources to create a fund that provides protection against potential losses and unforeseen circumstances. Contributions are made into a common fund; from this pool, individuals who suffer a covered loss are compensated. Any surplus funds remaining after claims and expenses are shared among participants under Islamic principles.

The purification of wealth is embedded within Takaful through the equitable distribution of funds. The surplus generated is not viewed as profits but rather as an excess that should be redistributed to participants or directed toward charitable causes. This practice ensures that wealth is protected and utilized in a manner that benefits the community as a whole.

Wassiyah

Second, we have Wassiyah, which ensures ethical distribution and legacy. Wassiyah is a mechanism that enables individuals to distribute their wealth per Islamic principles after their passing. It allows individuals to control the distribution of their assets, ensuring that their wealth is distributed ethically and in alignment with their beliefs.

Through Wassiyah, one can specify the beneficiaries of their estate and allocate shares of inheritance based on Islamic guidelines. This ensures that the distribution of wealth is fair and just, considering the rights of various family members, dependents, and charitable causes.

Wassiyah provides peace of mind to individuals and safeguards against potential disputes and conflicts that may arise after their demise. It allows for the orderly transfer of wealth and promotes harmony among beneficiaries by adhering to Islamic principles of inheritance.

Also, sometimes, you may veer off the plan and need extra cash. Or maybe, you don’t have enough to get your business off the ground. So, let’s look at two of the halal ways by which you can get support.

Murabaha and Musharaka

Of course, taking on a loan is something we’re always trying to avoid; in fact, Islamically, loans are strongly discouraged. That being said, sometimes there’s a real need for you to take on a loan. That’s where Murabaha and Musharaka come in as alternatives to traditional interest-based loans. Murabaha is a sales-based deal where a financial institution buys an asset on your behalf and sells it to you at an agreed price, including a markup. Murabaha allows you to buy assets without paying interest. On the other hand, Musharaka is a tag team between two or more people, where profits and losses are shared based on an agreed ratio. These principles are halal and provide you with ethical financial help without interest. Everyone gets stuck, and Murabaha and Musharaka are a helping hand.

How do you protect your Wealth?

As discussed in the previous sections, building wealth is a significant accomplishment. Still, it is equally important to implement measures that protect and preserve that wealth for future generations. Wealth protection strategies, like estate planning, Faraidh, Hibah Ruqbah, Waqf, and Nuzuriah, offer essential tools to ensure asset longevity and ethical management. How about we delve into these strategies and highlight their importance in safeguarding your wealth?

Securing your Legacy through Estate Planning

Estate planning is a comprehensive approach to organizing and managing your assets during your lifetime and after your passing. It involves creating legal structures and documents to ensure your wealth’s smooth transfer and distribution according to your wishes.

Through estate planning, you can designate beneficiaries, specify the division of assets, and establish contingency plans for unforeseen circumstances. By preparing a (shariah-compliant) will, trust, or other legal instruments, you provide clear instructions on how your wealth should be distributed and managed, minimizing the potential for disputes and preserving your legacy.

Faraidh

Faraidh is about the Islamic principles of inheritance. Faraidh is a system that governs the distribution of assets among heirs according to Islamic principles. It ensures fairness, equity, and adherence to religious guidelines in the division of wealth.

Following Faraidh, specific estate shares are allocated to various family members, depending on their relationship with the deceased. This system provides a framework that protects the rights of heirs, minimizes conflicts, and upholds justice in wealth distribution.

By understanding Faraidh and incorporating it into your estate planning, you can ensure that your wealth is distributed following Islamic principles and that the rights of your heirs are respected.

Hibah Ruqbah

This is Lifetime Gifting. Hibah Ruqbah refers to gifting or transferring assets during one’s lifetime as an act of benevolence and wealth preservation. It allows individuals to distribute their wealth proactively and experience the joy of giving while maintaining control over their assets. Islamically, giving money in charity is a great act of worship that multiplies your wealth rather than reducing it. In fact, Allah SWT tells us in the Qur’an:

“The parable of those who spend their property in the way of Allah is as the parable of a grain growing seven ears (with) hundred grains in every ear…”(2:261)

The verse tells us that everything we give in charity has the ability to give us a return on investment of 700%.

By making strategic Hibah Ruqbah arrangements, you can transfer assets to your heirs or other beneficiaries, potentially reducing inheritance’s complexities and tax implications. It also allows you to witness the impact of your generosity and support your loved ones’ financial well-being while maintaining financial security during your lifetime.

Waqf

Waqf is a charitable endowment in which individuals dedicate specific assets or funds to benefit society or specific causes. It is a perpetual act of charity that ensures the preservation and utilization of wealth for the betterment of the community.

Creating a Waqf allows you to allocate assets, like real estate, cash, or investments, to support charitable organizations, educational institutions, healthcare facilities, or any other cause that aligns with your values and philanthropic goals. Waqf serves as a means of wealth preservation and provides ongoing rewards in the form of continuous charity (Sadaqah Jariyah).

Nuzuriah

Nuzuriah refers to voluntary contributions made towards specific goals or objectives. It allows individuals to dedicate funds or assets to fulfill personal vows or commitments, often associated with religious or spiritual aspirations.

Through Nuzuriah, you can allocate resources to support charitable projects, undertake pilgrimage (Hajj or Umrah), or finance community initiatives. By fulfilling these voluntary obligations, you not only purify your wealth but also contribute to the betterment of society and earn spiritual rewards.

How do you distribute your Wealth?

Wealth distribution is crucial in fostering social cohesion and addressing economic disparities. In the space of Islamic finance, zakah, infaq, and sadaqah are principles that promote the equitable distribution of wealth and encourage acts of generosity. Let’s discuss these concepts and highlight their significance in empowering communities through wealth distribution.

Sadaqah

Sadaqah is a general term that encompasses voluntary acts of charity and kindness. It can involve giving money, goods, or services to those in need without specific obligations or restrictions. Sadaqah can be offered at any time and in any amount, depending on an individual’s capacity and willingness to give.

Sadaqah is vital in promoting compassion, empathy, and social solidarity. It allows individuals to contribute to various causes, like supporting orphanages, providing clean water access, offering medical aid, or assisting disaster-stricken communities. Through sadaqah, individuals can make a positive difference in the lives of others, irrespective of their financial means, which is why it’s important to make it a habit to give to charity on a regular basis.

Infaq

Infaq refers to voluntary spending for charitable purposes beyond the obligatory zakah. It embodies the spirit of generosity and encourages individuals to go beyond their minimum obligations in contributing to the welfare of society.

Infaq can take various forms, including providing financial assistance, supporting educational initiatives, funding healthcare services, or investing in infrastructure development. Infaq allows individuals to give back to their community, empowering them to make a positive impact through their wealth and resources.

Conclusion

Mastering money and wealth management is an ongoing journey that needs knowledge, discipline, and thoughtful decision-making. Understanding the basics of earning, saving, and consumption lays the groundwork for a financially secure future. Whether it’s maximizing your earning potential, considering ethical financing options, building a habit of saving, or practising responsible consumption, each aspect plays a crucial role in achieving personal financial goals. We’ve come a long way, so make sure you don’t miss our last edition for June where we will discuss financial planning.