The Power of Financial Planning

What is Financial Planning?

Welcome to our penultimate June edition! Financial planning is a strategic approach to managing your finances, ensuring long-term stability, and realizing your financial goals. Your planning covers various aspects like charity, investments, risk management, insurance, and retirement. In this blog post, we will look at the importance of financial planning and delve into concepts like Zakat, investment, risk mitigation, Takaful, and pensions. We aim to see how the mentioned concepts help you secure a prosperous financial future. We can’t close this intro without talking about the handy 50-30-20 rule. Here’s how it works: when you receive your income, you allocate 50% of it to your needs and fixed expenses like rent, bills, and food. The next 30% is for your wants and lifestyle choices like dining out, entertainment, or shopping. The remaining 20% is dedicated towards your financial goals, like saving for emergencies and investing. By following this rule, you can balance meeting your immediate needs and securing your financial future. Let’s start with investment because that’s where your financial river flows. You can’t pour from an empty cup, right? So, let’s see the importance of filling up our cups first.

Investment

Investment is ploughing money into an asset with the expectation of getting returns or profits over time. This is like planting and expecting a harvest. By the way, it’s essential to know that land doesn’t care what you sow. It will give you a yield from what you plant. The same applies to investments. It involves buying assets like stocks, crypto, real estate, or businesses to grow wealth. Investing needs careful analysis, risk assessment, and diversification to balance potential gains and risks. When you include investments in your financial plans, you harness the power of growing and creating wealth that can support your financial goals, like education, retirement, or wealth preservation. As good as this sounds, there’s no investment without risk, and it’s for us to jump into ways of reducing our risks.

Risk Mitigation

Risk mitigation basically means reducing risk. For example, you’re outside, and it suddenly starts to rain. You can reduce the effects of rain by using an umbrella or wearing a raincoat, but if you don’t have either, you’ll be rained on pretty well. Risk mitigation is like that umbrella or raincoat, and it’s a crucial part of financial planning. Risk reduction protects your financial health against possible risks and unforeseen events. Diversification, asset allocation, and setting up emergency funds are effective risk mitigation techniques. So, let’s look at one of the halal ways to prepare yourself for unforeseen events or risks.

Takaful

Takaful is an Islamic concept of cooperative insurance based on mutual assistance and shared responsibility. Takaful is a halal way to protect against financial losses or risks by pooling participant contributions. Takaful works on the Islamic principles of solidarity, fairness, and ethical conduct. When you participate in Takaful schemes as part of financial planning, you get insurance coverage while aligning with Islamic religious beliefs and values. Now that you’re all set, never forget to help those in need. Far from improving their well-being, you’ll also have some satisfaction and peace of mind by your deeds. Even companies and corporations do corporate social responsibilities. There’s no better feeling than knowing you used your resources to better someone else’s life. Sharing is caring, and you can do this through Zakat.

Zakat

Zakat is an essential pillar of Islamic finance. It refers to the obligatory giving of a portion of your wealth to help those in need. Zakat is considered a religious duty to purify one’s wealth. Zakat is typically calculated as 2.5% of your total accumulated wealth. It is given to eligible recipients like the poor, needy, and those in debt. Incorporating Zakat into your financial planning allows you to contribute to the betterment of society while maintaining a balanced approach to wealth accumulation. As you remember those in need, don’t forget to set something aside for your twilight years.

Pension

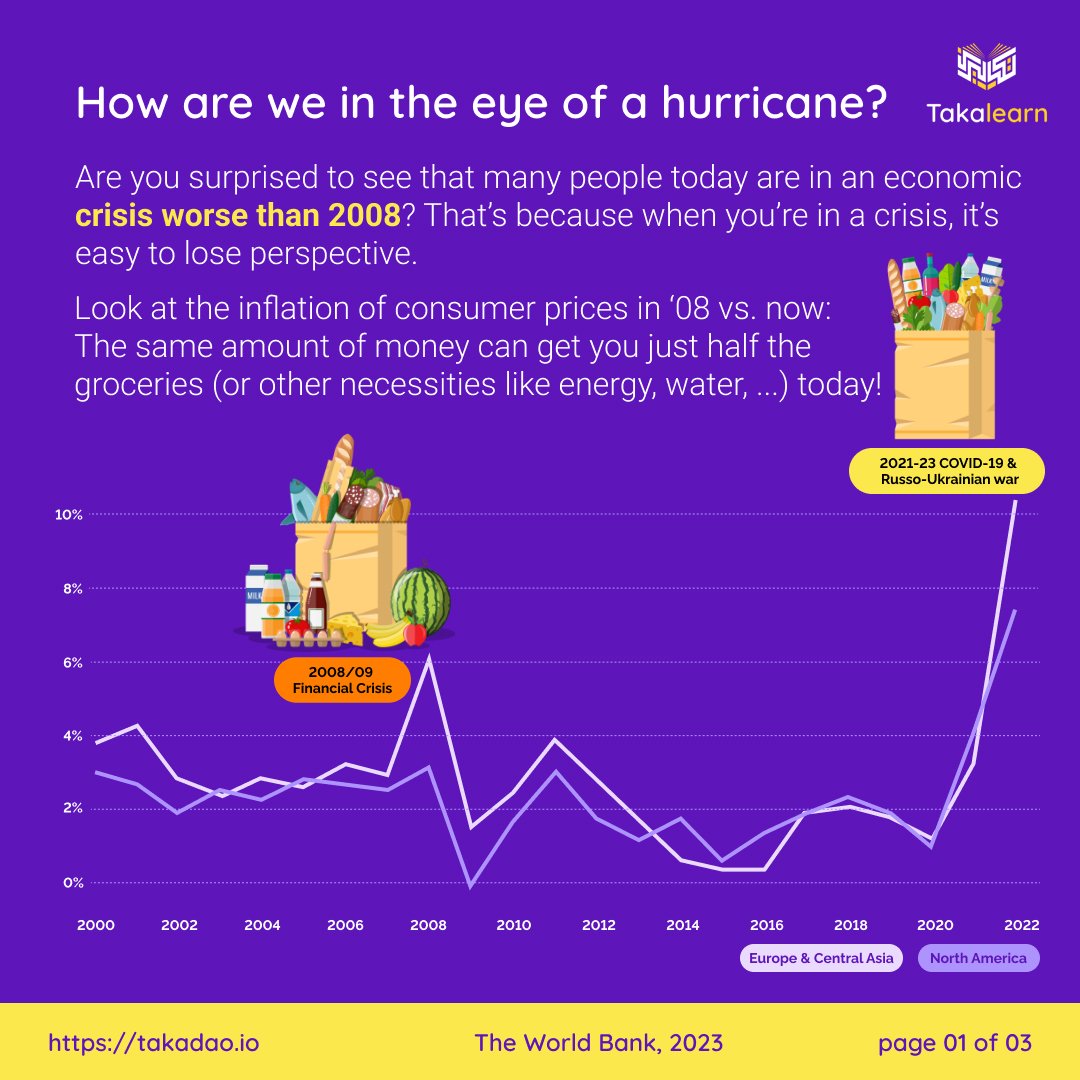

Pension planning is a crucial part of your long-term financial plans. Pension focuses on building funds to support people during their retirement years. Pensions can be employer-sponsored plans or personal retirement accounts. By contributing regularly to pension plans, you accumulate savings over time, which can provide a reliable income stream in retirement. It is essential to start planning for your retirement early, considering factors like your desired lifestyle, inflation, and expected longevity.

Conclusion

Financial planning is essential for people who want financial security and to realize their long-term goals. The concepts we’ve discussed align with ethical and religious values and contribute to your personal growth, social responsibility, and financial well-being. Expect exciting and informative content next month about everything related to Shariah compliance.