Master the Code: Unleash the Power of Financial Literacy

What is Financial Literacy?

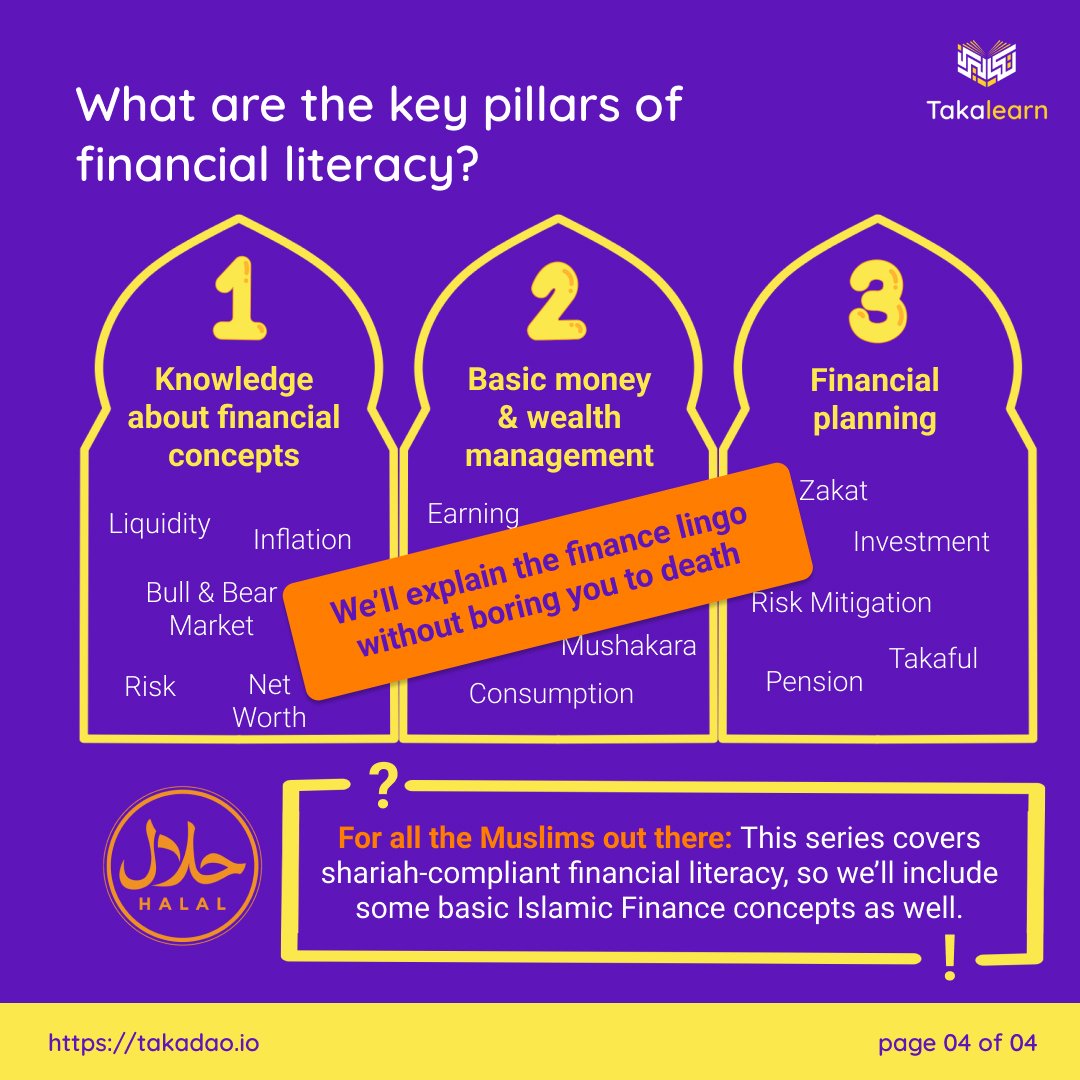

In June, Takalearn is about financial literacy and how to start the journey to financial freedom. We will look at an overview of financial literacy with a pinch of Islamic finance concepts. Financial literacy means to be able to understand and effectively manage your finances. It involves having the knowledge and skills needed to make the right decisions about money matters, like budgeting, saving, investing, and managing debt. So, financial literacy is about more than just knowing how to balance a chequebook or understanding the basics of interest rates. It involves various financial concepts and skills, like understanding credit scores, managing debt, and planning retirement.

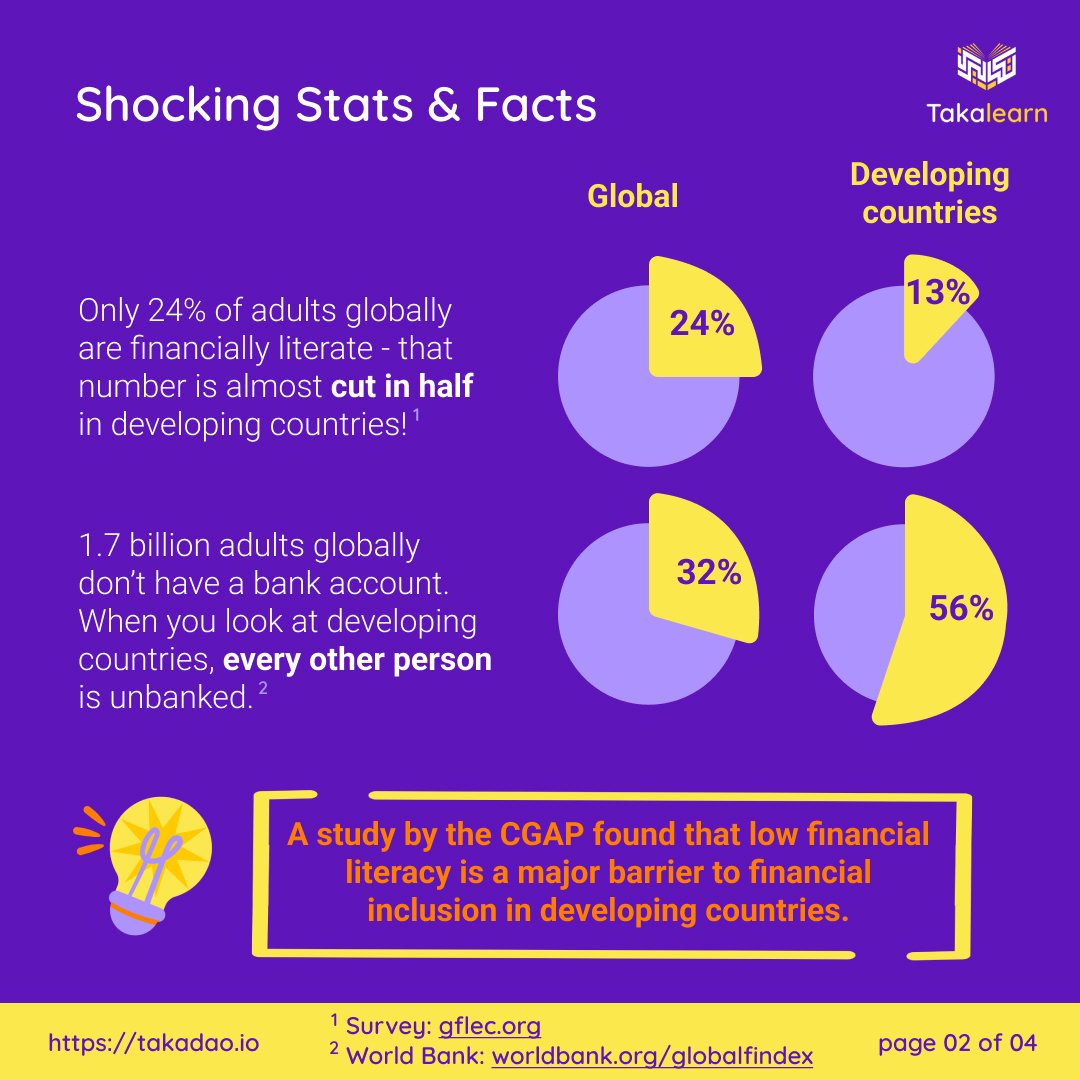

The way we see it, every single human on this planet should know the rules of the game they’re a part of so they can make informed decisions about their finances; but sadly, many people don’t.

So, why is financial literacy so important? That’s what we’ll discuss in this article, so keep on reading.

Empower Yourself

Financial literacy gives you the tools you need to take control of your finances and make informed decisions. It allows you to set realistic financial goals, create a budget, and make the right decisions about investments and savings. With financial literacy, you can make informed decisions to help them achieve their financial goals and secure their future.

Financial literacy empowers people to build a strong foundation of financial well-being, increase their financial security, and improve their overall quality of life.

Financial literacy empowers us in several ways:

You will make informed decisions: With the knowledge and skills to make informed money decisions, you can budget, save, invest, and avoid debt.

Build your financial confidence: Once you understand financial concepts and strategies, you feel more capable and knowledgeable to make financial decisions. This confidence reduces anxiety and stress about money matters, enabling you to approach financial challenges with control.

Your shield against financial exploitation: With the knowledge to identify and protect yourself from financial scams, fraud, and predatory practices, you become more aware of your consumer rights and can better recognize warning signs or deceptive financial offers.

Increased financial independence: With the knowledge and skills gained, you can make sound financial decisions, plan for the future, and achieve self-sufficiency. This independence gives individuals greater control over their financial outcomes and reduces the risk of being financially vulnerable.

Get financial stability and realize your long-term financial plans

Financial literacy is essential for promoting financial stability. When people have the knowledge and skills to manage their finances effectively, they are less likely to experience financial hardship or debt. Planning for retirement, saving for a child’s education, and other long-term financial goals require a high level of financial literacy. With this knowledge, all of us can make better decisions that can have a lasting impact on our financial future. Let’s look at some ways in which you can achieve financial stability and long-term financial goals:

Budgeting and Money Management: You learn how to create and stick to a budget. By understanding your income, expenses, and spending patterns, you have the power to allocate resources effectively, avoid overspending, and build savings.

Setting your long-term goals: Once you’re clear on what your plans are for, say, retirement savings, homeownership, education, or starting a business, you can set clear goals and create a roadmap for your financial future to achieve them.

Debt Management: Taking on a loan is so normalized in today’s day and age. The problem is being in debt keeps you in a vicious cycle of dependency; which is one of the reasons why it is strongly disliked (makruh) in Islamic finance as well. Taking charge of your finances keeps you from having to take on debt in the first place.

Saving and Investments: Financial stability comes from prioritizing saving and investing. Through long-term financial plans, you establish a safety net to withstand unforeseen expenses or job loss by understanding the importance of building an emergency fund and long-term savings.

Risk Management: Once you understand different types of insurance, like health, life, and property insurance, you’re halfway there. Be informed that risk management isn’t just about insurance but also having a diverse investment portfolio to spread risk. As a result, you can protect yourself and your assets from unexpected events that could otherwise cause significant financial strain.

Retirement Planning: Good planning helps you understand the importance of starting early, regularly contributing to retirement accounts, and exploring various retirement investment options. With proper retirement planning, we can secure their financial future and maintain stability later.

Avoiding financial scams

Financial scams are a growing pain, and they can be devastating for people who fall victim to them. Financial literacy helps you recognize and avoid scams, protecting you and your family from financial loss and fraud.

Here’s how financial literacy helps you against scams:

You become aware of common scams: This is because you get educated about common financial scams, like phishing emails, identity theft, pyramid schemes, and investment fraud.

Knowing red flags: You will learn to identify characteristics like promises of quick and guaranteed returns, high-pressure sales tactics, requests for personal or financial information, and unsolicited offers.

Knowledge of Personal Information Security: Emphasis is put on safeguarding personal and financial information. We learn about safe online practices, like using strong passwords, avoiding sharing sensitive information through unsecured channels and being cautious about sharing information with unknown parties.

Evaluation of Financial Offers: You’ll also know how to critically evaluate financial offers and products. So, you conduct research, ask questions, and read the fine print before making financial decisions.

Seeking Professional Advice: When dealing with complex financial matters, it is crucial to seek advice from trusted and reputable professionals, like financial advisors or lawyers. Financial literacy teaches you to verify credentials, check for professional affiliations, and seek second opinions before making major financial decisions.

Reporting and Taking Action: You dare to report scams and act appropriately if targeted or victimized. People learn about reporting channels, like local law enforcement, consumer protection agencies, and fraud hotlines, and understand the steps to take in case of financial fraud.

Overall economic growth

Financial literacy is important not just for individuals but also for the economic growth of your country because it helps you to invest in the stock market, start businesses, and make other financial decisions that promote economic growth and prosperity.

Here’s how financial literacy contributes to economic growth:

Increased Financial Inclusion: This is probably the most impactful change. Through knowledge, you get to really understand how the system works and how you can use it for a better future. The more people get this knowledge, the more can participate in the formal economy of your country, which boosts the economy, creates jobs, and overall has everyone better off.

Entrepreneurship and Small Business Development: Once you have skills like financial management, business planning, access to capital, and risk management, you can start your own business. So, financial literacy stimulates innovation, creates job opportunities, and drives economic growth.

Consumer Spending and Investment: With the proper knowledge, you are more likely to make informed decisions about spending and investment choices. You will also understand the importance of saving, budgeting, and avoiding debt. Increased consumer spending and responsible investment choices have a positive impact on various sectors of the economy.

Reduced Dependence on Social Welfare Programs: The more people are empowered to become self-sufficient, the less they need to rely on social welfare programs. This reduces the burden on public assistance programs and allows governments to allocate resources more efficiently toward other areas of economic development.

Financial Stability and Resilience: You’ll also be able to manage financial risks and withstand economic shocks. Financially stable and resilient people are better positioned to contribute to economic growth through sustained productivity, entrepreneurship, and investment.

Informed Investors and Capital Markets: You will better understand investment options and the functioning of capital markets. This leads to more informed investment decisions, increased participation in capital markets, and more significant capital mobilization. Robust capital markets and knowledgeable investors contribute to economic growth by channeling resources toward productive investments and supporting businesses’ access to capital.

Conclusion

In conclusion, financial literacy is a crucial skill that you should possess. It empowers you, promotes financial stability, helps you avoid financial scams, is essential for long-term financial planning, and is necessary for economic growth.

Excited to learn more? Keep an eye for our weekly blog posts to learn the rules of the game and take control of your money to secure your financial future!