The Digitalization of Money

A Journey from Barter to Crypto

Origin of Money

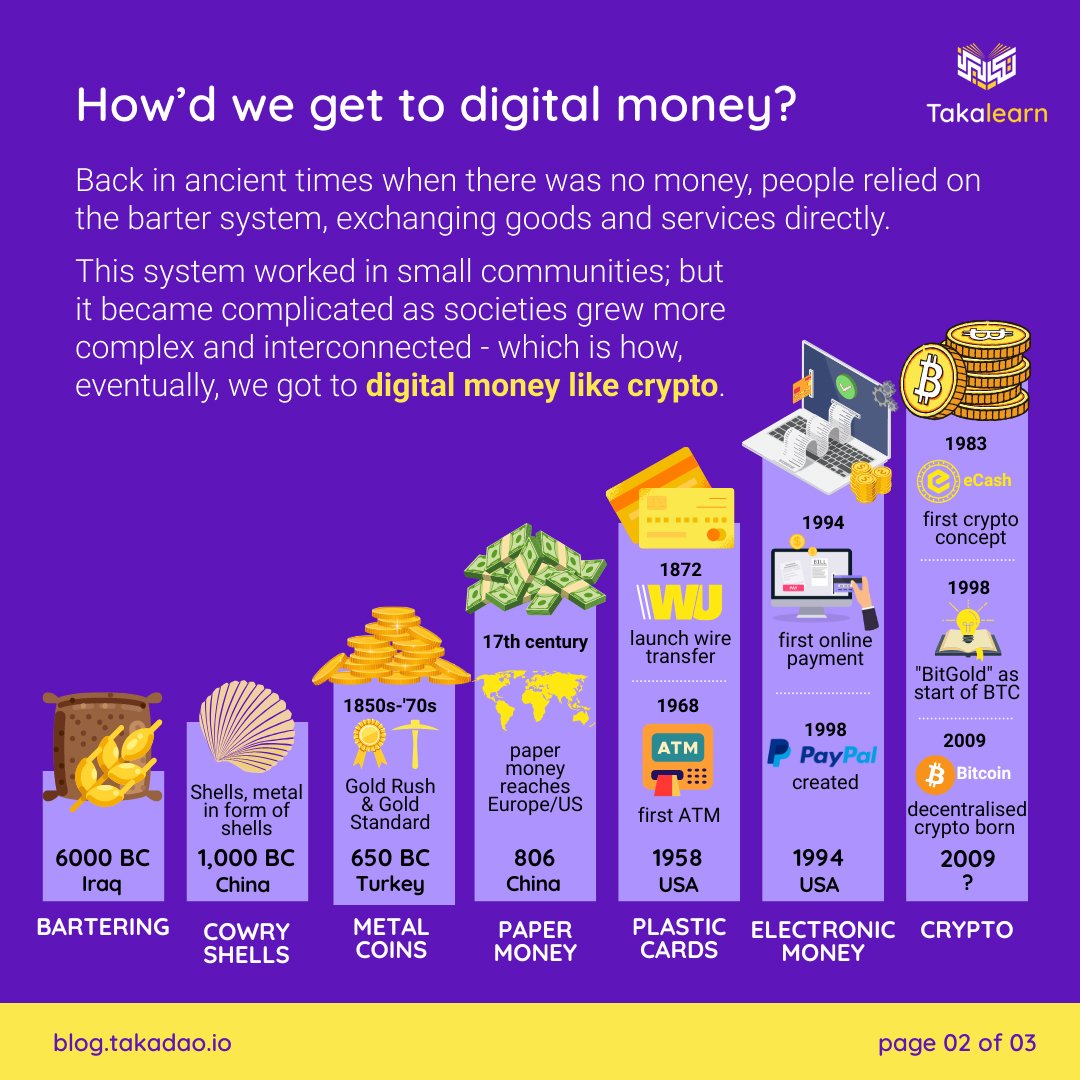

At some point, you have thought about the concept of money, how it started and how it has changed over time. From the days of bartering to the era of digital currencies, money has come a long way. Let’s say you’re back in ancient times when the concept of money hadn’t even existed. People relied on the barter system, exchanging goods and services directly. For example, you would trade livestock for clothing if you needed it. Even though this system worked in small communities, it became complicated as societies grew more complex. So, this triggered humans to develop something more effective, as discussed in the next section.

The Evolution of Currency

As the barter system proved cumbersome, people started using stuff like seashells, beads, or even precious metals like gold and silver as mediums of exchange. These mediums of exchange held value and were more convenient to trade with. Over time, coins emerged, becoming standardized and widely accepted forms of currency.

Fast forward to China during the Tang Dynasty (around the 7th century AD), when paper money was born. The world witnessed the introduction of paper money. Governments and merchants issued banknotes that represented a specific value in precious metals. This development revolutionized trade and paved the way for modern fiat currencies.

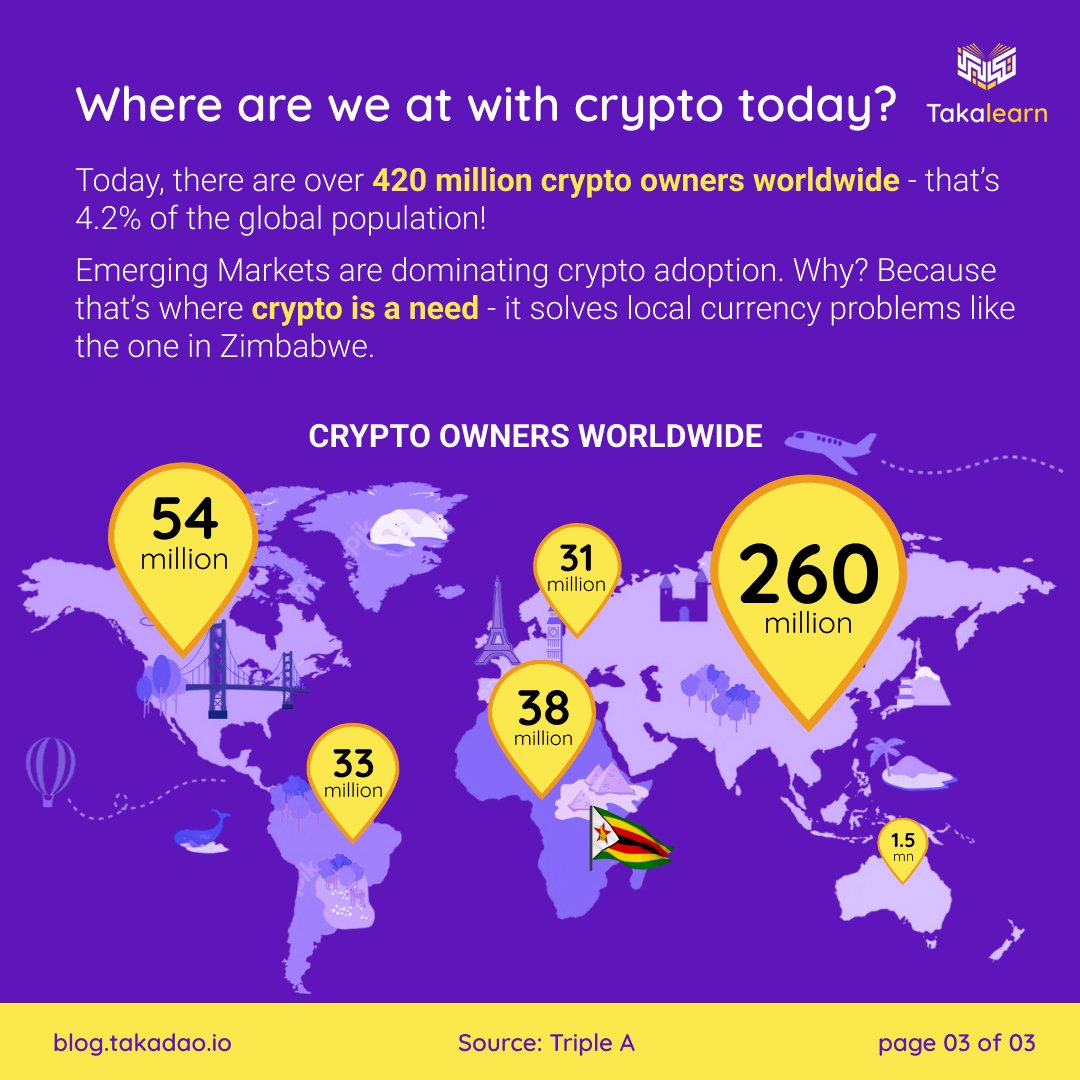

We are in the modern era, where the digital revolution has taken centre stage. The advent of computers and the internet brought about an unprecedented shift in how we interact with money. It started with digitizing banking systems, where we could access our accounts online and conduct transactions electronically. The founding of Western Union and PayPal are some notable events in the journey to digital currencies. After a while came the rise of digital currencies, which prepared the way for Crypto.

The digitalization of money reached new heights with the introduction of Crypto. Bitcoin, created by an anonymous person or group, Satoshi Nakamoto, emerged in 2009 as the first decentralized digital currency. Unlike traditional currencies, Crypto is not issued or controlled by any central authority, making them decentralized and secure. Next, we must look at digital money’s pros and cons. But before we delve into that, it’s important to say that the Crypto concept didn’t start with Bitcoin. The journey began over two decades before the birth of Bitcoin.

Let’s start with the concept of eCash. The roots of Crypto can be traced back to the early 1980s when computer scientist David Chaum introduced the concept of electronic cash or eCash. Chaum’s idea involved creating a digital currency that provided privacy and secure transactions through Cryptographic techniques. Although eCash itself did not materialize into a widely adopted Crypto, it laid the groundwork for future developments such as BitGold, which came in 1998.

In 1998, another computer scientist Nick Szabo proposed “BitGold,” an early precursor to Bitcoin. BitGold aimed to create a decentralized digital currency that utilized Cryptographic proof-of-work mechanisms to enable secure transactions and prevent double-spending. Although BitGold was never implemented, it introduced key concepts that would later influence the creation of Bitcoin.

Pros and Cons of Digital Money

Pros

Facilitates quick and efficient transactions

Eliminates the need for physical cash

Boosts financial inclusion. With just a smartphone, you can send money to someone across the globe within seconds.

Cons

Cybersecurity threats and the potential for financial exclusion for those without access to tech.

Which way forward?

As technology advances, the future of money looks exciting and dynamic. From mobile payments and contactless transactions to blockchain-powered financial systems, we’re witnessing a transformation that will reshape how we manage and use money. It’s an evolving journey that invites us to adapt and embrace new possibilities.

From the early days of bartering to the rise of Crypto, money has truly come a long way. As we navigate this ever-changing landscape, let’s remember that money is a tool that reflects our values and aspirations. So, whether you prefer physical cash or are diving headfirst into digital currencies, let’s keep embracing the possibilities and making the most of this fascinating journey.