The Global Shift: De-dollarization

What’s the trend?

In recent years, several countries have been moving away from the USD as the dominant international currency. This trend is known as de-dollarization, reshaping the global financial landscape and challenging the long-standing dominance of the USD. This first week of July will discuss de-dollarization and its effects and provide real-life cases highlighting this shift.

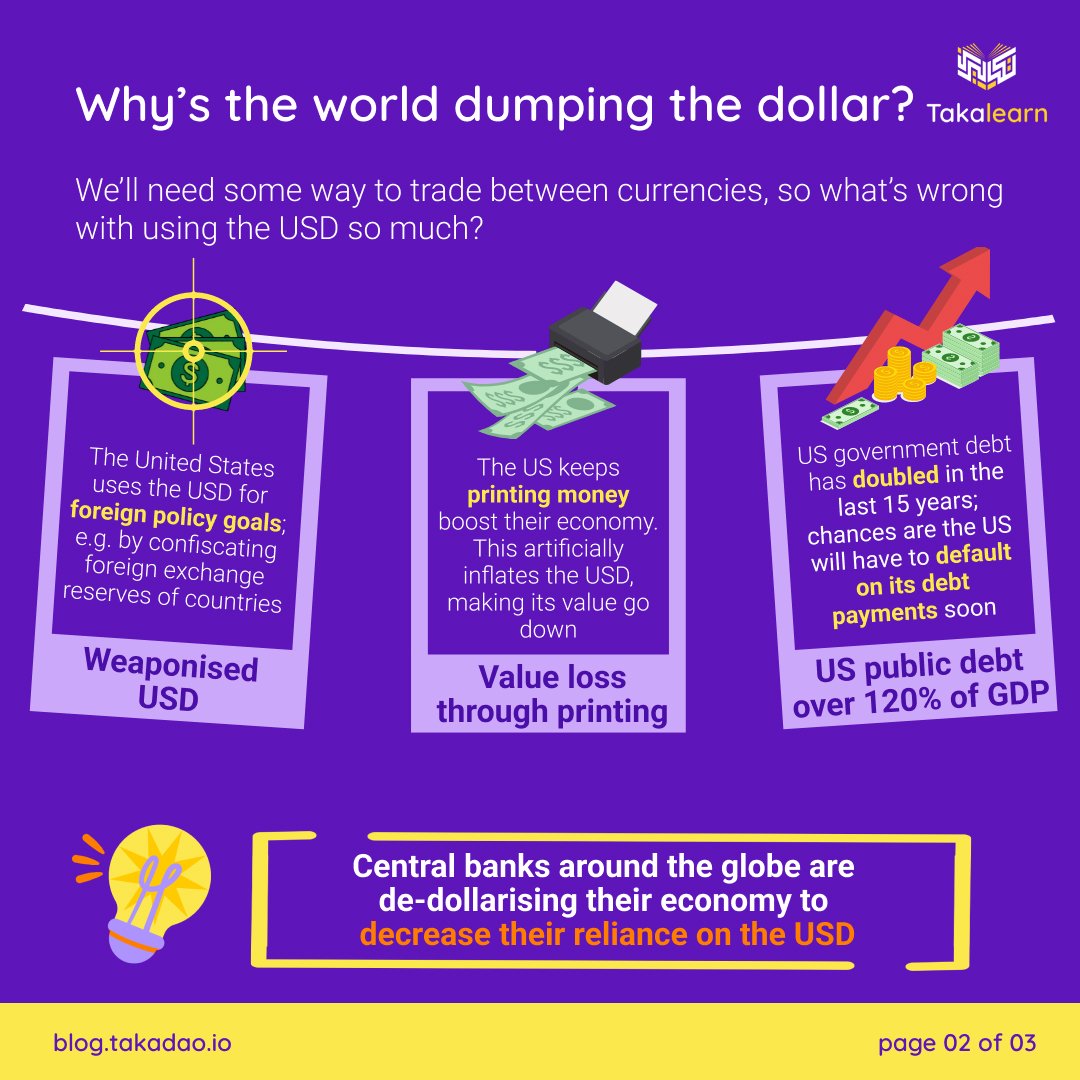

De-dollarization is the process by which countries reduce their dependence on the USD for international trade, financial transactions, and reserve holdings. Historically, the USD has played a major role in the global economy, acting as the primary currency for cross-border transactions and as a preferred reserve currency for many nations. However, several factors have spurred a growing desire among countries to diversify their currency holdings and reduce vulnerability to dollar fluctuations. Let’s look at some real-life examples of de-dollarization.

Examples of De-dollarization

Russia’s Shift to Euros and Yuan

Because of geo-political tensions and economic sanctions imposed by the US, Russia has actively pursued de-dollarization. The perfect example is its decision to increase the use of the euro and Chinese yuan in its international trade. Russia has been conducting energy deals with China in yuan instead of dollars, reducing its reliance on the USD. Additionally, to a higher degree, Russia has reduced its holdings of the US treasuries, spreading its reserves into other currencies and gold.

China’s Renminbi Internationalization

With its growing economic influence, China has been pushing for the internationalization of its currency, the renminbi (RMB). The Chinese government has signed currency swap agreements with other countries, enabling bilateral trade settlements in RMB. China has also been promoting using the RMB in international financial transactions. As the world’s largest trading nation, China’s efforts contribute to gradually de-dollarizing global trade and finance.

European Union and the Euro

In the aftermath of the global financial crisis of 2008, the EU sought to bolster the euro’s international role as an alternative to the USD. The EU has been encouraging euro-denominated invoicing in trade with non-EU countries and promoting using the euro in energy contracts, like oil and natural gas. These steps aim to reduce the EU’s exposure to dollar-related risks and strengthen the euro’s standing as a global currency.

Venezuela and the Petro

In a unique example of de-dollarization, Venezuela launched its state-backed crypto called the Petro. Faced with hyperinflation and US sanctions, Venezuela aimed to bypass the US financial system and international sanctions by utilizing a digital currency for trade and investment. While the Petro has faced scepticism and challenges, it represents a novel attempt to circumvent traditional currency dynamics and reduce dependence on the US dollar.

Argentina’s Shift

Argentina is taking steps to shift from its reliance on the USD towards other currencies. Argentina’s moving away is because of economic instability, inflation, and political tensions with the US. One key move by the Argentine government has been to increase the use of the Chinese yuan in trade with China. A currency swap agreement allows Argentina and China to exchange their currencies directly without going through the USD. By reducing the need for USD in international transactions, Argentina is less vulnerable to disruptions in the US economy or financial system.

Another factor driving Argentina’s shift away from the dollar is the country’s high inflation rate. The government has been struggling to control inflation, eroding the peso’s value and making it less desirable as a store of value. So, many Argentines have turned to other currencies as a hedge against inflation.

Also, the current government in Argentina has had a sour relationship with the US. It has led to a reduction of the country’s dependence on the US. So, Argentina is seeking closer ties with countries like China and Russia.

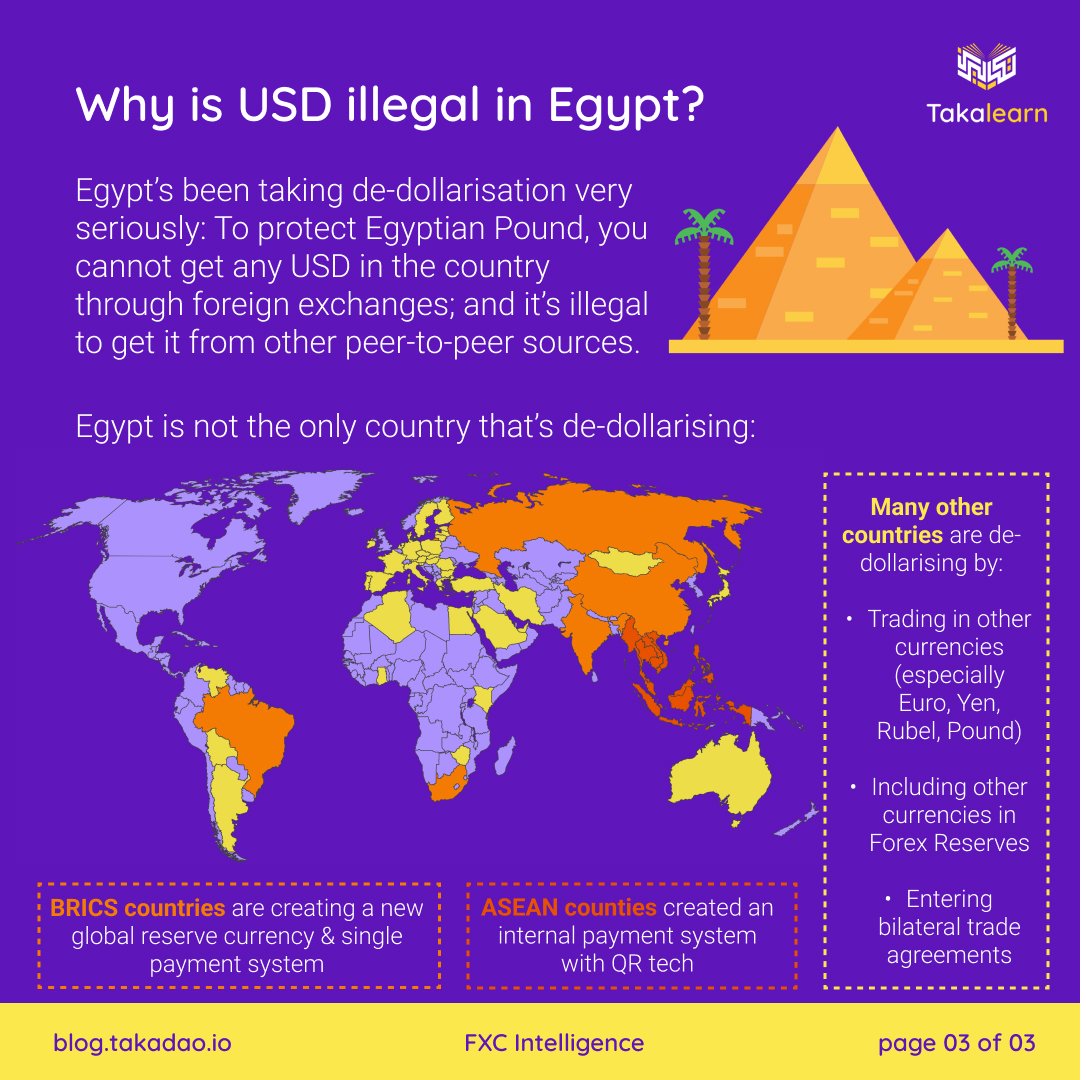

Overall, Argentina’s shift away from the USD shows a broader trend in the global economy towards a diverse currency system in which no single currency dominates international trade and finance. Far from Argentina, Brazil has also been all over the news lately, and it’s not just about their soccer rivalry. They’ve considered creating a common currency for their economies, more like a South American version of the Euro. And that’s not all. There’s a conference that went down in Singapore back in January. All the big shots from Southeast Asia discussed de-dollarization to reduce their reliance on the mighty greenback.

Further, UAE and India are also getting in on the action. They’re seriously discussing using the rupees for trading non-oil stuff. It’s like they want to break free from the dollar’s dominance. And let’s not forget that Saudi Arabia, the land of oil riches, has finally said that they’re open to trading in other currencies too.

The BRICS countries

Brazil, Russia, India, China, and South Africa have been at the forefront of the de-dollarization movement. These countries have been seeking to reduce their dependence on the USD in international trade and commerce and exploring alternative currency arrangements to achieve this goal.

One of the key drivers behind the BRICS’ push for de-dollarization has been the volatility of the USD. The dollar has been subject to significant fluctuations in recent years, making it difficult for countries to plan their economic policies and trade strategies. In addition, the dominance of the USD has given the US great power and influence in global affairs, which has been seen as a threat to the sovereignty of other countries.

To overcome these challenges, the BRICS countries have explored various alternative currency arrangements. One of the most notable examples is the BRICS New Development Bank, established in 2014 to fund infrastructure and development projects in emerging economies. The bank is financed in local currencies rather than USD, which has helped to reduce the dependence of these countries on the USD.

Another example of de-dollarization in action is the China-led Asian Infrastructure Investment Bank (AIIB). The AIIB was established in 2015 to provide funding for infrastructure projects across Asia and has attracted significant support from countries worldwide. Like the BRICS New Development Bank, the AIIB is funded in local currencies, which has helped reduce the dominance of the US dollar in international trade.

Effects of De-dollarization

The shift towards de-dollarization carries both opportunities and challenges for the global economy. On the one hand, de-dollarization promotes currency diversification, potentially reducing vulnerabilities to the USD’s fluctuations. It also fosters greater economic autonomy for countries and enhances their resilience to external shocks. Conversely, de-dollarization can increase currency volatility, transaction costs, and complex financial adjustments.

We can compare de-dollarization to the protest against the centralized financial system by adopting Crypto. The traditional centralized financial system is controlled by the US, and people are drifting away from it by getting into Crypto.

Conclusion

The global trend of de-dollarization signifies a gradual rebalancing of economic power. It highlights the desire of nations to reduce dependence on a single currency. In conclusion, de-dollarization is a growing global trend driven by economic, political, and strategic considerations. The BRICS countries have been at the forefront of this movement and have been exploring a range of alternative currency arrangements to reduce their dependence on the US dollar. While the process of de-dollarization is likely to be slow and gradual, it is clear that the global economy is undergoing significant change, with new players and new ideas emerging to challenge the dominance of the US dollar.